The Main Principles Of G. Halsey Wickser, Loan Agent

Table of ContentsG. Halsey Wickser, Loan Agent - The Facts7 Easy Facts About G. Halsey Wickser, Loan Agent ExplainedHow G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.3 Simple Techniques For G. Halsey Wickser, Loan AgentThe Main Principles Of G. Halsey Wickser, Loan Agent

When working with a home mortgage broker, you must clarify what their cost framework is early on in the procedure so there are no surprises on closing day. A home mortgage broker commonly just gets paid when a finance shuts and the funds are released.The majority of brokers don't set you back debtors anything in advance and they are generally risk-free. You need to use a home loan broker if you desire to locate access to home mortgage that aren't conveniently advertised to you. If you do not have remarkable credit report, if you have an one-of-a-kind borrowing situation like owning your own service, or if you simply aren't seeing mortgages that will certainly benefit you, then a broker may be able to get you accessibility to financings that will be valuable to you.

Home mortgage brokers might likewise have the ability to help financing candidates get approved for a lower interest rate than most of the business car loans use. Do you need a mortgage broker? Well, working with one can save a borrower effort and time throughout the application procedure, and potentially a lot of cash over the life of the financing.

Our G. Halsey Wickser, Loan Agent Ideas

A specialist home loan broker comes from, works out, and refines property and industrial mortgage on part of the customer. Below is a six point guide to the solutions you must be used and the expectations you must have of a certified home loan broker: A home mortgage broker uses a large range of mortgage from a variety of different lending institutions.

A home mortgage broker represents your interests instead than the rate of interests of a loan provider. They need to act not only as your representative, but as an educated expert and problem solver - G. Halsey Wickser, Loan Agent. With accessibility to a variety of mortgage items, a broker has the ability to use you the best worth in terms of rate of interest rate, payment quantities, and lending items

Lots of circumstances require even more than the basic use of a thirty years, 15 year, or flexible price home mortgage (ARM), so innovative home loan strategies and sophisticated remedies are the advantage of dealing with a skilled mortgage broker. A mortgage broker navigates the customer with any kind of circumstance, taking care of the procedure and smoothing any type of bumps in the roadway along the way.

G. Halsey Wickser, Loan Agent Fundamentals Explained

Debtors that discover they require larger car loans than their financial institution will approve additionally take advantage of a broker's understanding and ability to effectively obtain financing. With a home loan broker, you only require one application, rather than completing types for each and every private lending institution. Your mortgage broker can give an official contrast of any type of lendings advised, directing you to the info that precisely represents cost distinctions, with present prices, factors, and closing prices for each and every loan reflected.

A respectable home mortgage broker will divulge exactly how they are paid for their solutions, along with information the complete expenses for the funding. Individualized solution is the differentiating aspect when choosing a mortgage broker. You need to expect your home mortgage broker to aid smooth the way, be readily available to you, and suggest you throughout the closing procedure.

The journey from fantasizing regarding a new home to actually possessing one may be loaded with obstacles for you, especially when it (https://advertisingflux.com/classifieds/ads/317257/g-halsey-wickser-loan-agent/finance/) pertains to securing a mortgage funding in Dubai. If you have actually been presuming that going right to your financial institution is the most effective course, you may be losing out on an easier and possibly much more useful option: functioning with a home loans broker.

G. Halsey Wickser, Loan Agent Fundamentals Explained

Among the significant benefits of using a home loan consultant is the expert economic suggestions and essential insurance coverage guidance you receive. Mortgage professionals have a deep understanding of the different monetary products and can help you choose the best mortgage insurance policy. They make certain that you are adequately covered and supply guidance tailored to your financial situation and long-term objectives.

A home mortgage brokers take this concern off your shoulders by managing all the documents and application processes. Time is cash, and a home mortgage car loan broker can conserve you both.

This indicates you have a much better opportunity of discovering a mortgage in the UAE that perfectly suits your requirements, consisting of specialized items that could not be readily available through conventional banking networks. Browsing the home mortgage market can be confusing, especially with the myriad of items offered. An offers expert advice, aiding you understand the advantages and disadvantages of each alternative.

4 Easy Facts About G. Halsey Wickser, Loan Agent Shown

This professional guidance is indispensable in safeguarding a home mortgage that lines up with your financial goals. Home loan advisors have actually established relationships with several lending institutions, providing them substantial discussing power. They can protect much better terms and prices than you may be able to obtain by yourself. This bargaining power can cause substantial financial savings over the life of your home loan, making homeownership more budget friendly.

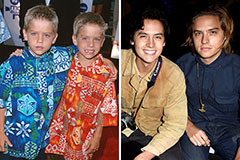

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!